Why We’re Different from Other Lenders

Absolute Business Capital is your trusted partner for business financing, combining decades of expertise with a deep understanding of local markets. We specialize in tailored solutions to help you achieve your goals, offering fast access to innovative loan products for restaurants, hospitality, and retail businesses.

With exclusive partnerships with community banks nationwide, we provide quick loans with higher amounts, longer terms, and fixed, tax-deductible payments. Simplify your financing journey with manageable solutions that grow with your business.

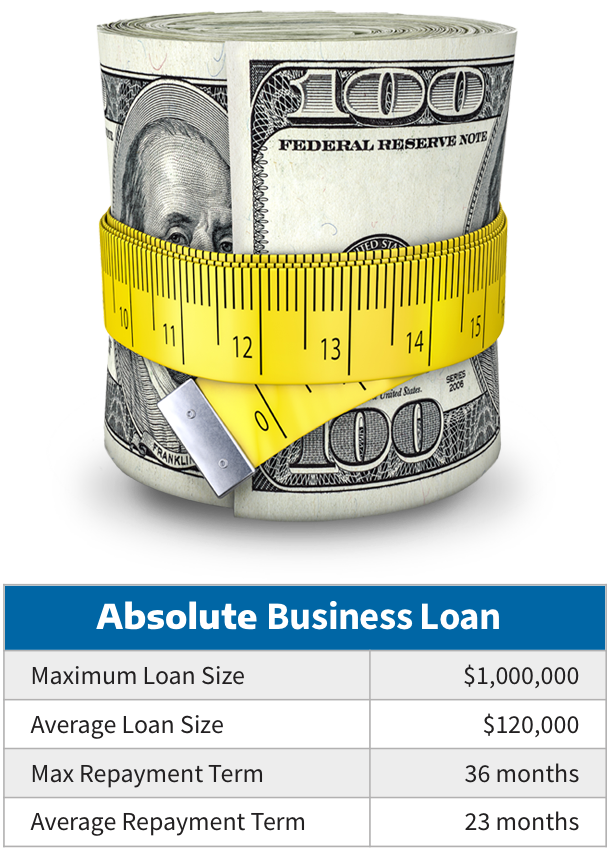

Size Matters!

When choosing a business lender, SIZE MATTERS! Big projects require substantial upfront funding—something a merchant cash advance often can’t provide. If you’re planning significant growth for your business, we offer financing that’s just the right fit. Borrow up to $1,000,000 with terms of up to 36 months, keeping your costs low and manageable.

Our loans are, on average, six times larger and have repayment terms more than three times longer than a typical Merchant Cash Advance. This means you can seize growth opportunities that boost your bottom line without straining your cash flow. Take a look at the comparison below!

UNDERWRITING GUIDELINES

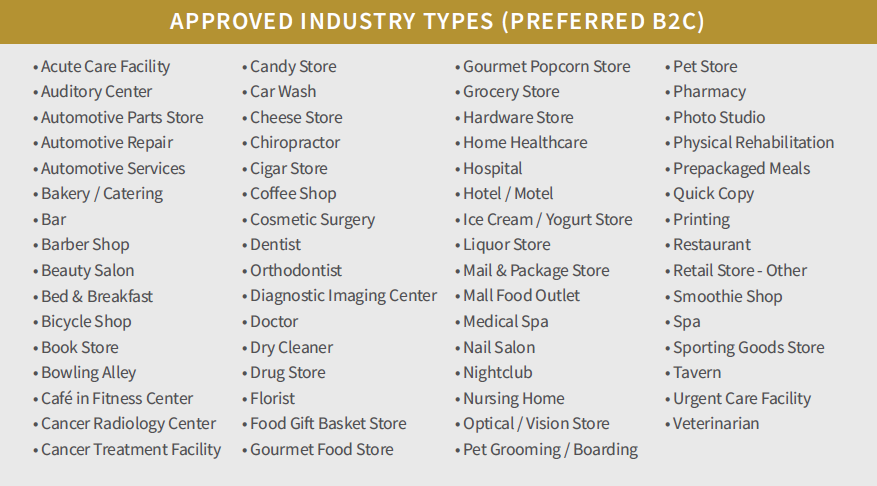

Preferred Industries (B2C)

- Minimum 1 month time in business (same ownership)

- Minimum monthly sales of $17,000

- Loan amounts up to $500,000 for single entities

- Loan amounts up to $750,000 for multiple entities

- Fixed terms from 12 to 36 Months

- We can pay off up to 2 competitors (short-term loans)

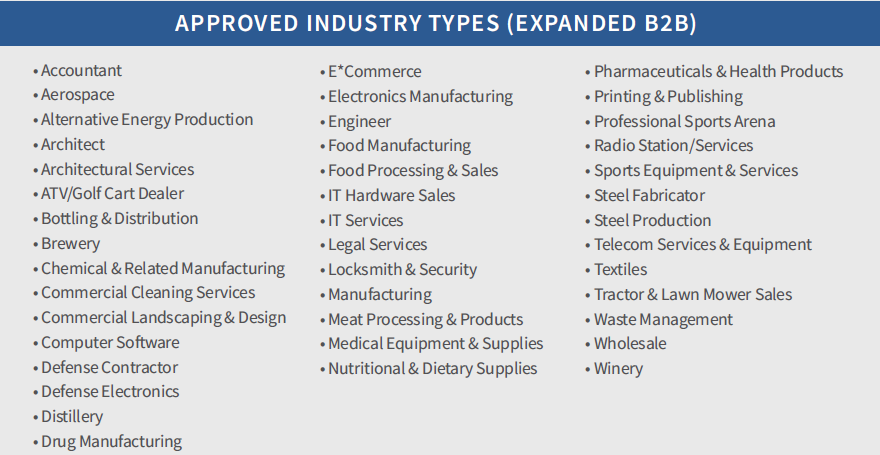

Expanded Industries (B2B)

- Minimum 2 years time in business (same ownership)

- Minimum monthly sales of $17,000

- Loan amounts up to $500,000 for single entities

- Loan amounts up to $750,000 for multiple entities

- Fixed repayment terms from 12 to 36 Months

- We can pay off up to 2 competitors (short-term loans)

LOAN PROGRAM ADVANTAGES

- Loan amounts from $5,000 to $1,000,000

- Fixed repayment terms from 12 to 36 months

- Fast approvals and fundings in under a week

- Revolving lines of credit with interest-only options

- Unlimited access to draws for up to a year*

- Unlimited principal paydowns for up to a year*

- Loan repayment is not tied to credit card transactions

- Minimal documentation requirements

- Early pay-off options are available

- The interest paid is tax deductible

Revolving Line of Credit

Approvals of up to $750,000 with

minimum initial draw of $5,000.

Unlimited draws and partial

principal paydowns during the

revolving period of up to 1 year!

24-Month Terms

Longer Repayment terms man

lower payments. Minimum loan

amount is $5,000. Minimum annual

sales is $250,000.

36-Month Terms

Longer Repayment terms mean

lower payments. Minimum loan

amount is $250,000. Minimum

annual sales is $1,500,000.

Quick and Easy Online Application

The quickest way to apply is our convenient online application. Get approved in 24 to 48 hours! There are 5 easy steps, It only takes 10 minutes and won’t affect your credit!

Our Bank Partnerships